ATTENTION: As Of January 29 2025 9:46 AM We Still Have A Select Few Elite Insider Memberships Available at The Founding Member Discount Rate... SECURE YOUR ACCESS Before They're Gone

REVEALED: How to leverage INSIDER TRADING ACTIVITY

to BEAT THE MARKET!

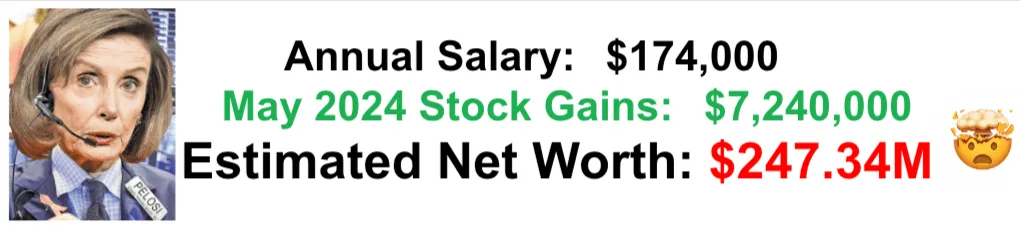

Ever wonder how a public servant like Nancy Pelosi, famously on a $174,000 annual salary, raked in $7.24 million in stock gains in just one month? Or how her estimated net worth soared to a staggering $247 million? It's high time you got answers and the power to mimic such astounding financial feats.

Nancy Pelosi: The Unlikely Wolf of Wall Street

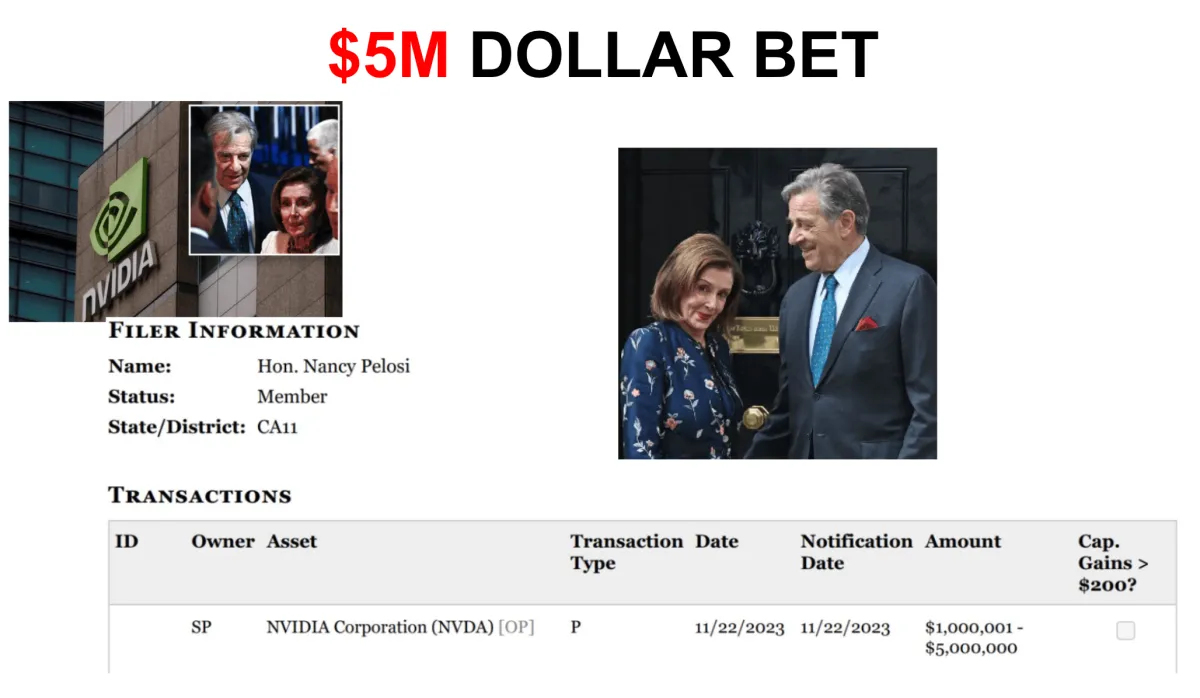

Picture this: Pelosi, with no prior trading background, confidently placing a $5 million bet on Nvidia and securing a massive profit. How?

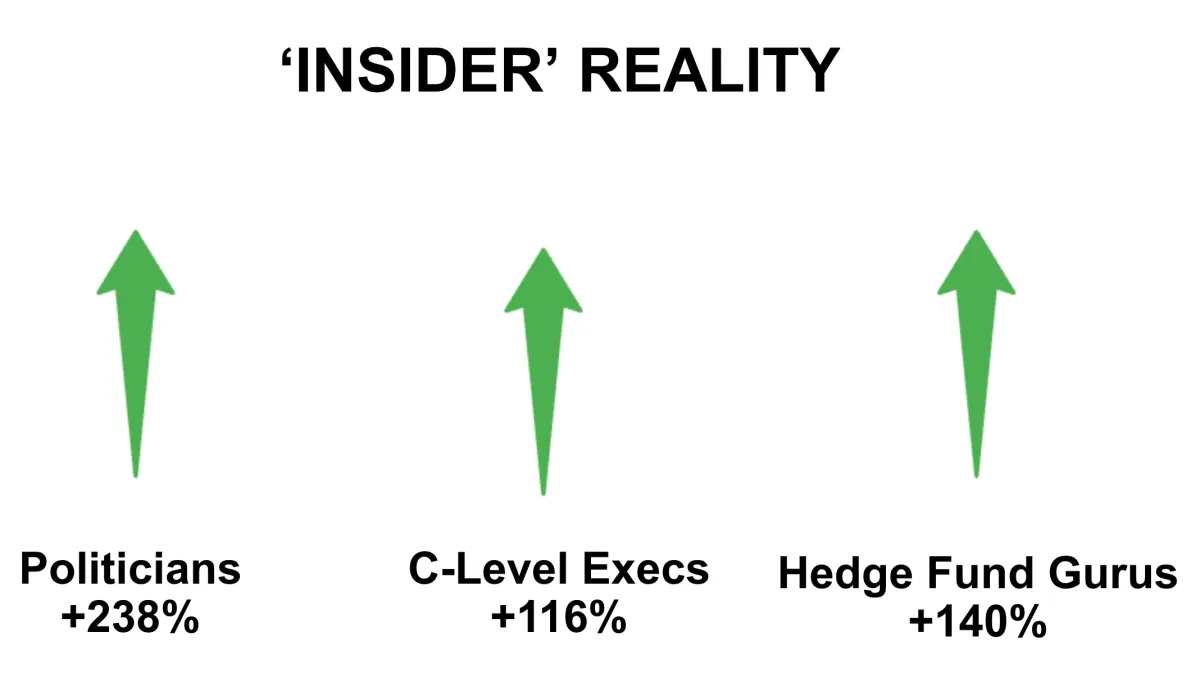

She knows something the average investor doesn’t. And it’s not just her; it’s an entire echelon of political traders posting unreal gains:

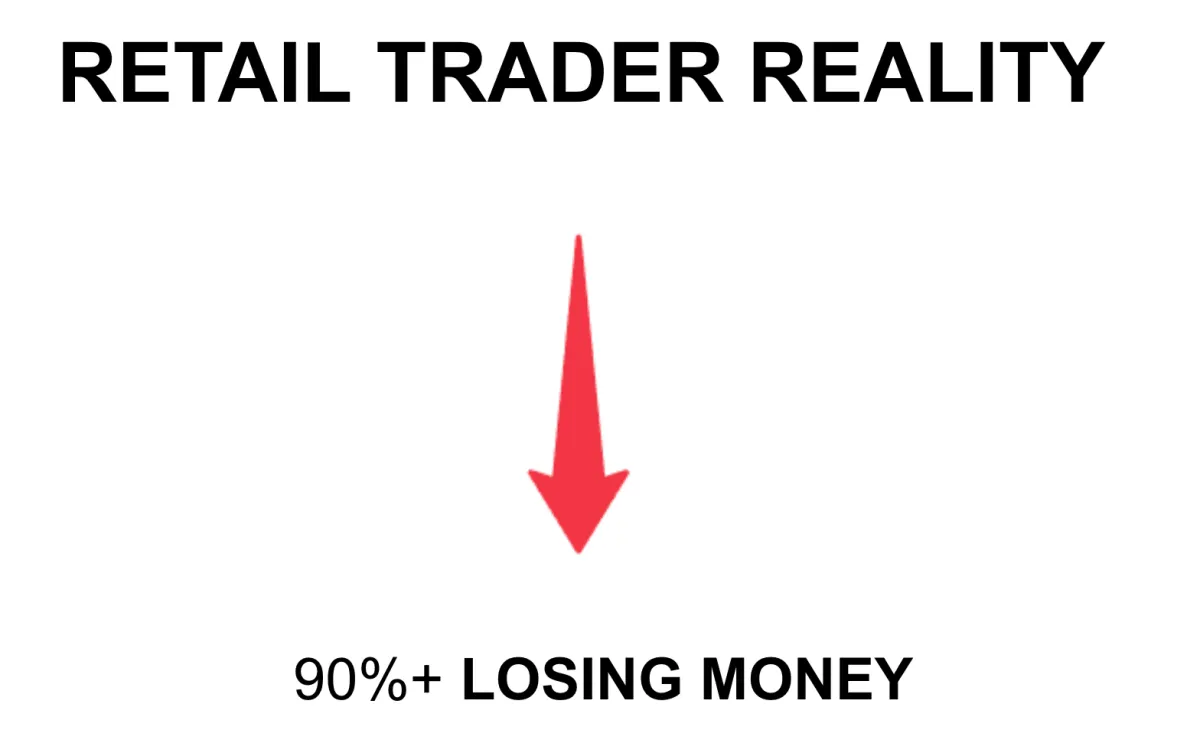

While 90% of retail traders struggle or lose money

These politicians are not just surviving; they’re thriving with gains that would make professional hedge fund managers envious.

The Political Leverage Over Retail Traders

These aren't just lucky guesses. Politicians have serious leverage because they sit on influential committees. For instance:

The Committee on Oversight: Over $9.9 million in trades across 435+ transactions, averaging $22,758 each.

The Committee of Homeland Security: A whopping $11.4 million in trades over 272 transactions, averaging $41,912 each.

Imagine placing just one trade per day at these averages. Even a tenth of this could mean over $1 million in annual profits for you.

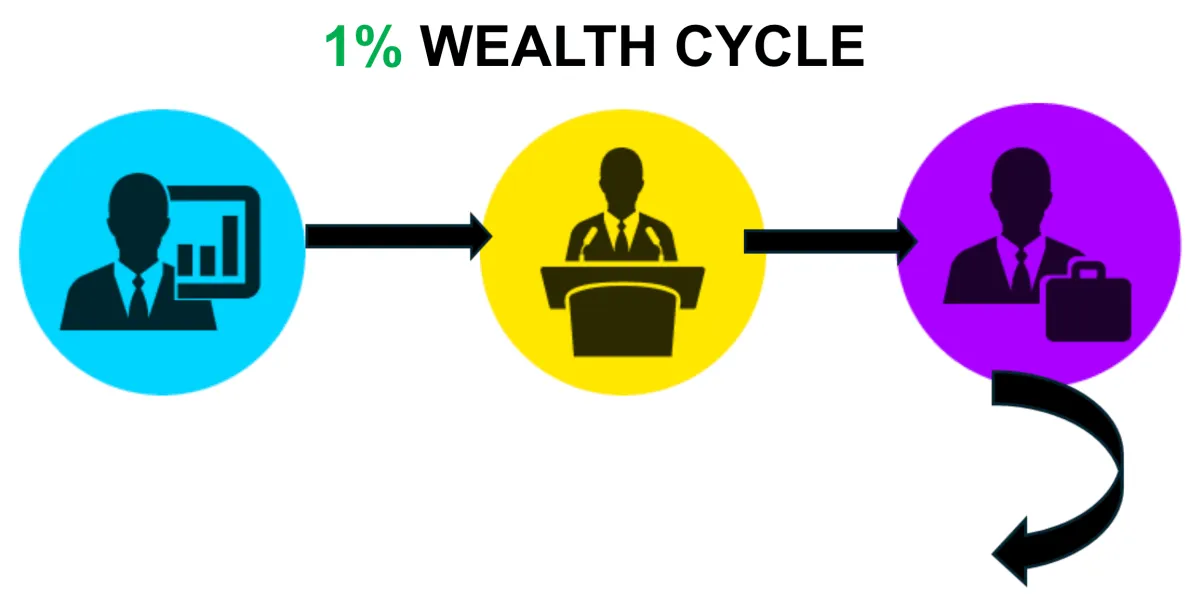

The Power of Collective Insider Action: Unveiling the Wealth Cycle

When you hear about the staggering profits being made by insiders, it's not just individual luck or isolated incidents. There's a deeper, more systematic strategy at play, often referred to as the "wealth cycle." This cycle involves the coordinated actions of various insiders—Political, Hedge fund, and Corporate—who align their trades to maximize returns. Their collective movements not only impact the market but often predict its direction.

Case Studies of Coordinated Insider Success

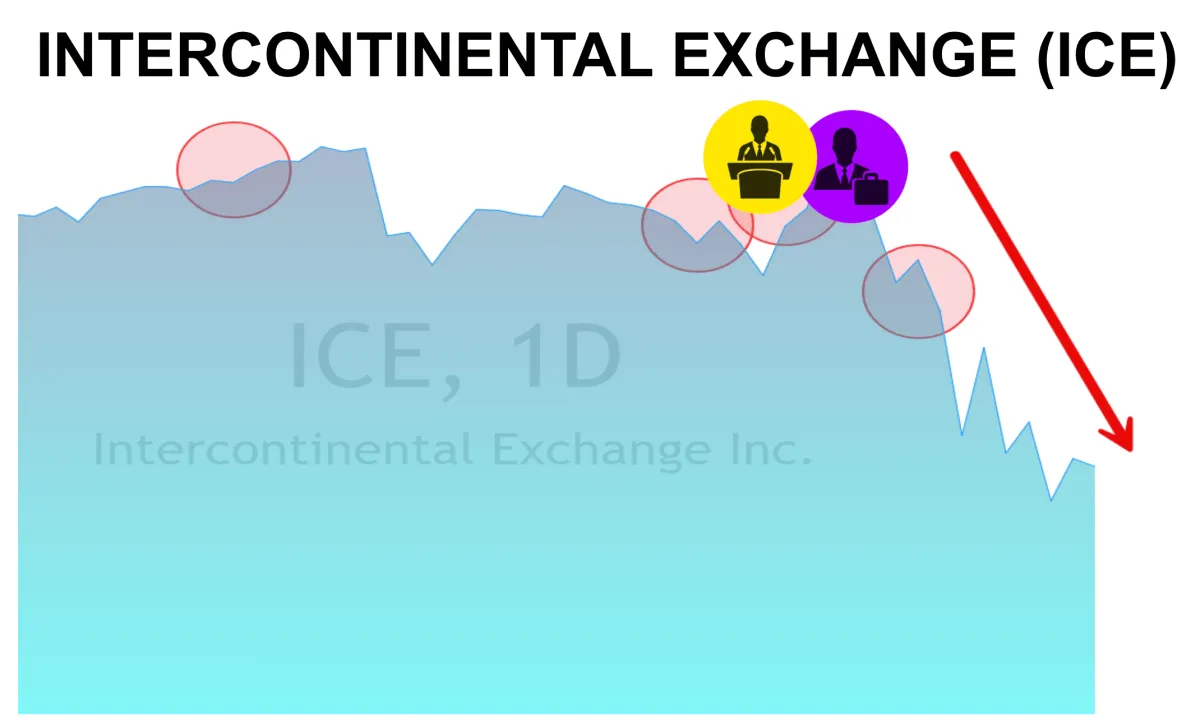

Take, for example, the significant trades that shook the market:

Intercontinental Exchange: Not just one, but multiple insiders acted just before regulatory changes were announced, resulting in soaring stock prices.

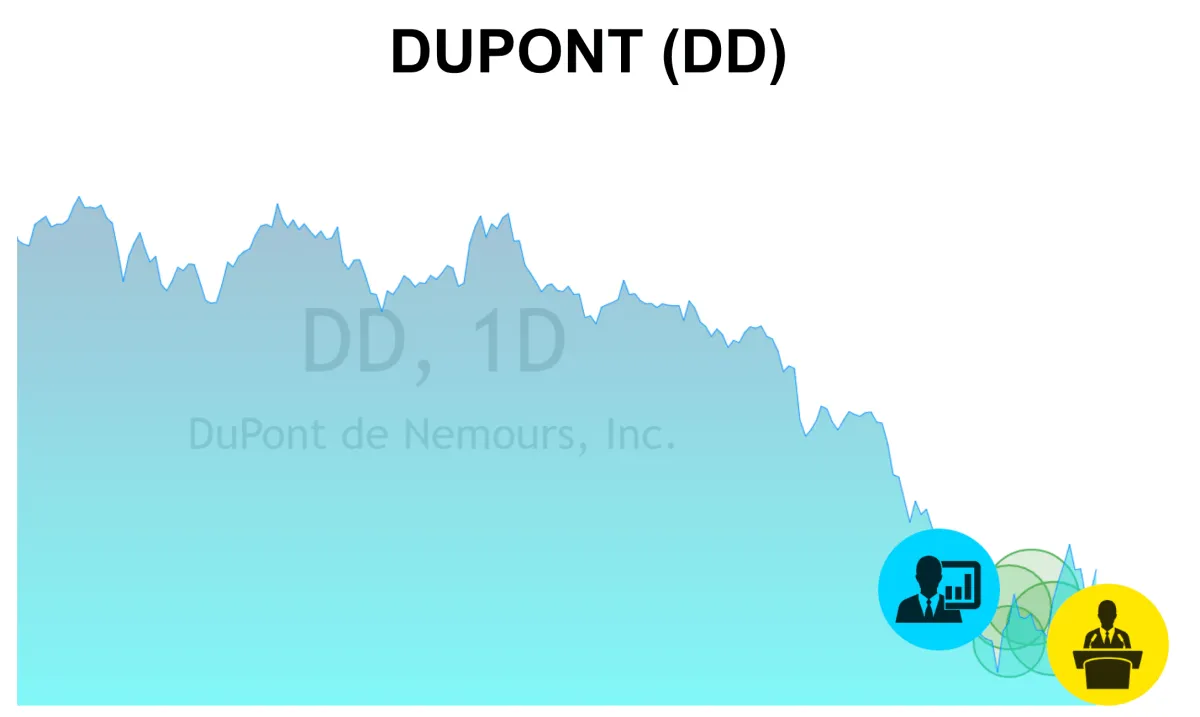

DuPont: When insiders across the spectrum moved in unison, they capitalized on pending corporate restructuring announcements that spiked the stock value.

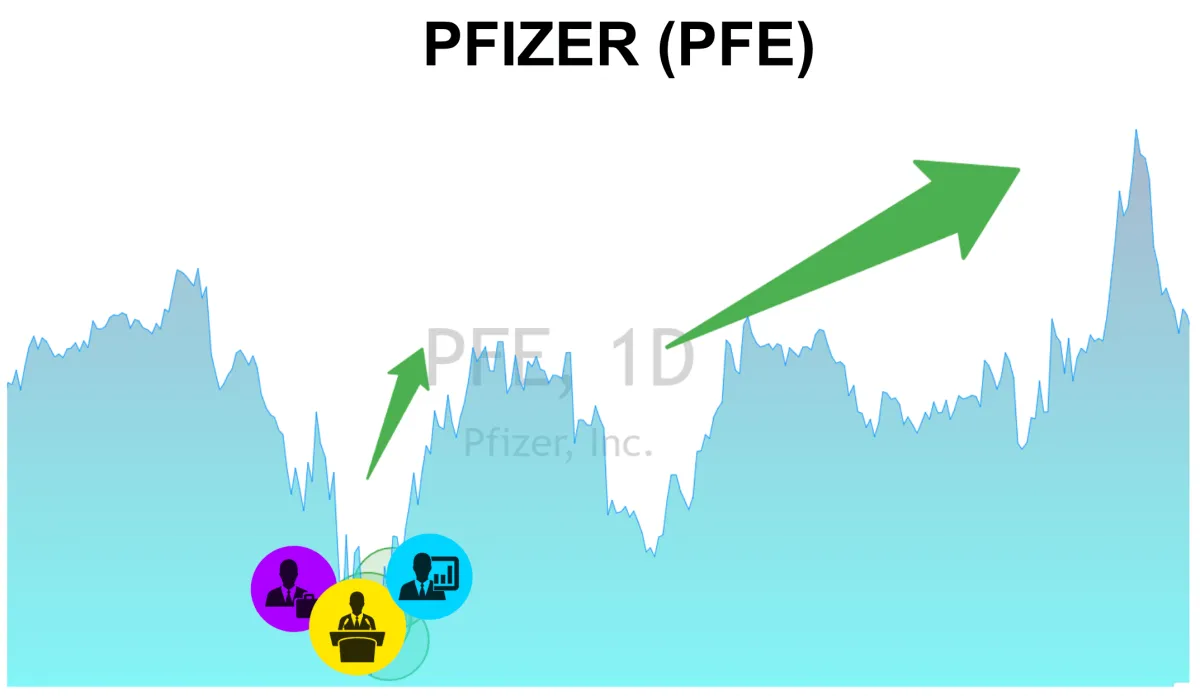

Pfizer: As legislation hinted at the imminent need for widespread COVID-19 vaccinations, our dashboards detected a pattern of insider trades that anticipated the public explosion in demand—and subsequent surge in stock prices.

These are not mere coincidences. They are calculated moves made possible by privileged information that these insiders have access to due to their positions and connections.

Ron Wyden’s Wife: A Prime Example of Insider Trading Proficiency

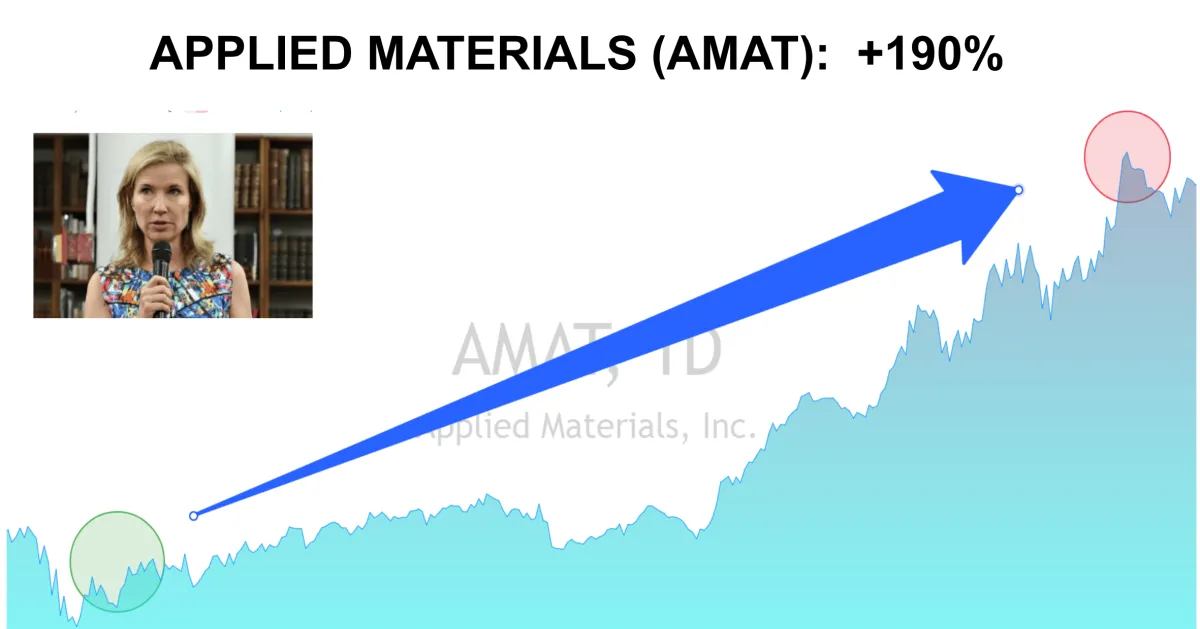

Highlighting the power of insider knowledge, consider the case of Senator Ron Wyden’s wife, who, with no formal background in trading, made exceptionally lucrative trades:

Applied Materials: A staggering 190% gain from a well-timed trade that seemed to preempt market-moving news.

KLA Corp: Another brilliant move with a 124% gain, aligning suspiciously with semiconductor industry shifts not yet public.

These instances vividly illustrate how insiders leverage their unique positions within the wealth cycle to secure profits that are out of reach for the average investor.

Why This Matters to You!

Understanding and observing these wealth cycles can offer you unprecedented advantages. By tracking when and how these insiders trade, you can potentially mirror their movements. Elite Insider doesn’t just provide you with data; it offers you the opportunity to see through the noise of the market and align your trading strategy with the most informed entities in the financial world.

Exclusive Founding Member Offer: Unlock Comprehensive Insider Access

When you sign up today as a founding member of Elite Insider, you're not just gaining access to a powerful tool; you're securing an all-access pass to the inner workings of the financial elite.

This limited-time offer grants you immediate entry to not only the Elite Political Insider Dashboard but also the Elite Hedge Fund Insider and Elite Corporate Insider Dashboards. These comprehensive platforms provide a panoramic view of the moves shaping the markets from the top down.

But that's not all. As a founding member, you will also receive Elite Insider Alerts. These are not just notifications—they are detailed analyses of the most significant trading opportunities happening right now. Each alert provides specific Entry and Exit points and tailored advice on how to manage the trade, ensuring you have the best information at your fingertips to make informed decisions quickly.

Act Now—This Offer Won't Last

The current market environment is ripe with opportunities that our Elite Insider Dashboards are uniquely equipped to identify. From sudden legislative changes to quiet shifts in corporate boardrooms, the landscape is constantly evolving, and with it, the potential for substantial gains. As a founding member, you lock in access at today's price, which will increase shortly as we expand the platform's capabilities and reach.

Don't miss this chance to elevate your trading strategy with the most comprehensive insider trading tool available. Sign up now to become a founding member of Elite Insider, and start trading with the confidence and precision of the market's most informed players.

This is your gateway to trading alongside the giants of the industry, leveraging their insider knowledge for your personal gain. Secure your spot now before prices rise and ensure you are positioned to take full advantage of the dynamic market conditions.

What's Included

- ELITE INSIDER DASHBOARD & SCANNER

- Political Insider Dashboard Access

-

Corporate Insider Dashboard Access

-

Hedge Fund Insider Dashboard Access

- ELITIST CLUSTER BUYING SCANNER

- MOST ACTIVE + LARGEST TRADE ELITE SCANNER

- ELITE INSIDER TRADING CRASH COURSE

- INTERACTIVE CHARTING + DATA

- ELITE INSIDER PRIVATE SOCIETY COMMUNITY

- ELITE INSIDER PORTFOLIO ALERTS & PICKS

WANT TO BECOME AN ELITE INSIDER AT A SIGNIFICANT DISCOUNT?

CALL 502-383-1182

TODAY WHILE ENROLLMENT IS AVAILABLE

TOTAL VALUE

$7385

$1497

I created the Elite Insider Software Dashboard to give you the Retail Trader an edge in the market. To level the playing field between the everyday hard working Joe and the Elite of this world who control 99% of the Wealth in this Country. It is time for you to get a piece of the pie!

Silas Peters

- All payments are secured by 256-bit encryption.